Meals And Entertainment Deduction 2024

Meals And Entertainment Deduction 2024. Navigating around limits on meals and entertainment. 274 by eliminating the deduction for any expenses considered.

Certain expenses qualify for a 100% deduction. Posted on july 31, 2023.

Businesses Are Allowed To Deduct Meals And Entertainment Costs From Their Gross Income.

Deductions for meals, snacks, overtime meals, entertainment and functions.

Navigating Around Limits On Meals And Entertainment.

Meals and entertainment expense deductions can be confusing — especially when rules and.

This Article Is Tax Professional Approved.

Final regulations on the meals and entertainment deduction (2024) by c.

Images References :

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg) Source: karliewlib.pages.dev

Source: karliewlib.pages.dev

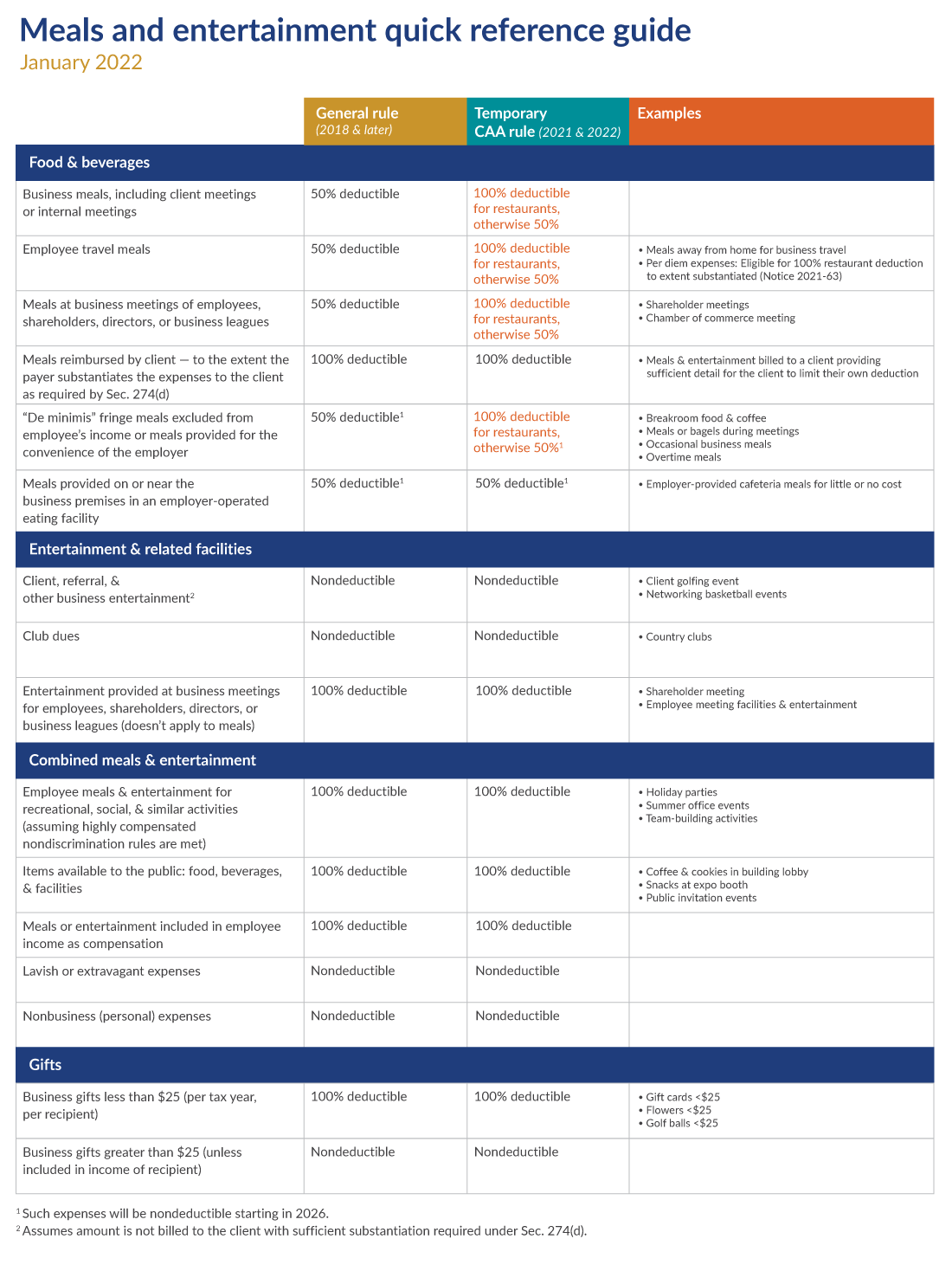

Irs 2024 Meals And Entertainment Deductions patti sharity, As of january 1, 2023, the meals and entertainment deduction. Writing off meals and entertainment for your small business can be pretty confusing.

Source: www.plantemoran.com

Source: www.plantemoran.com

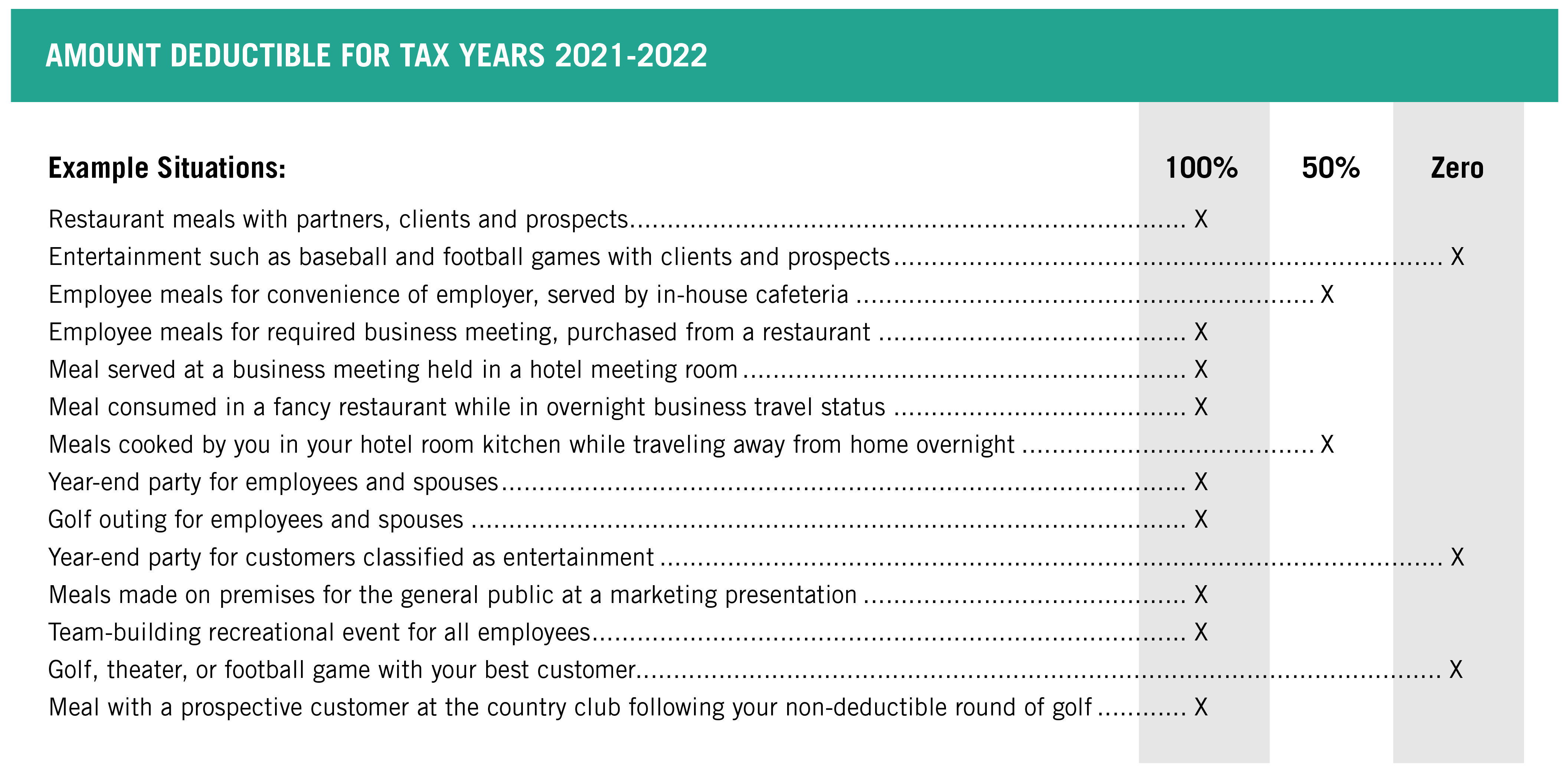

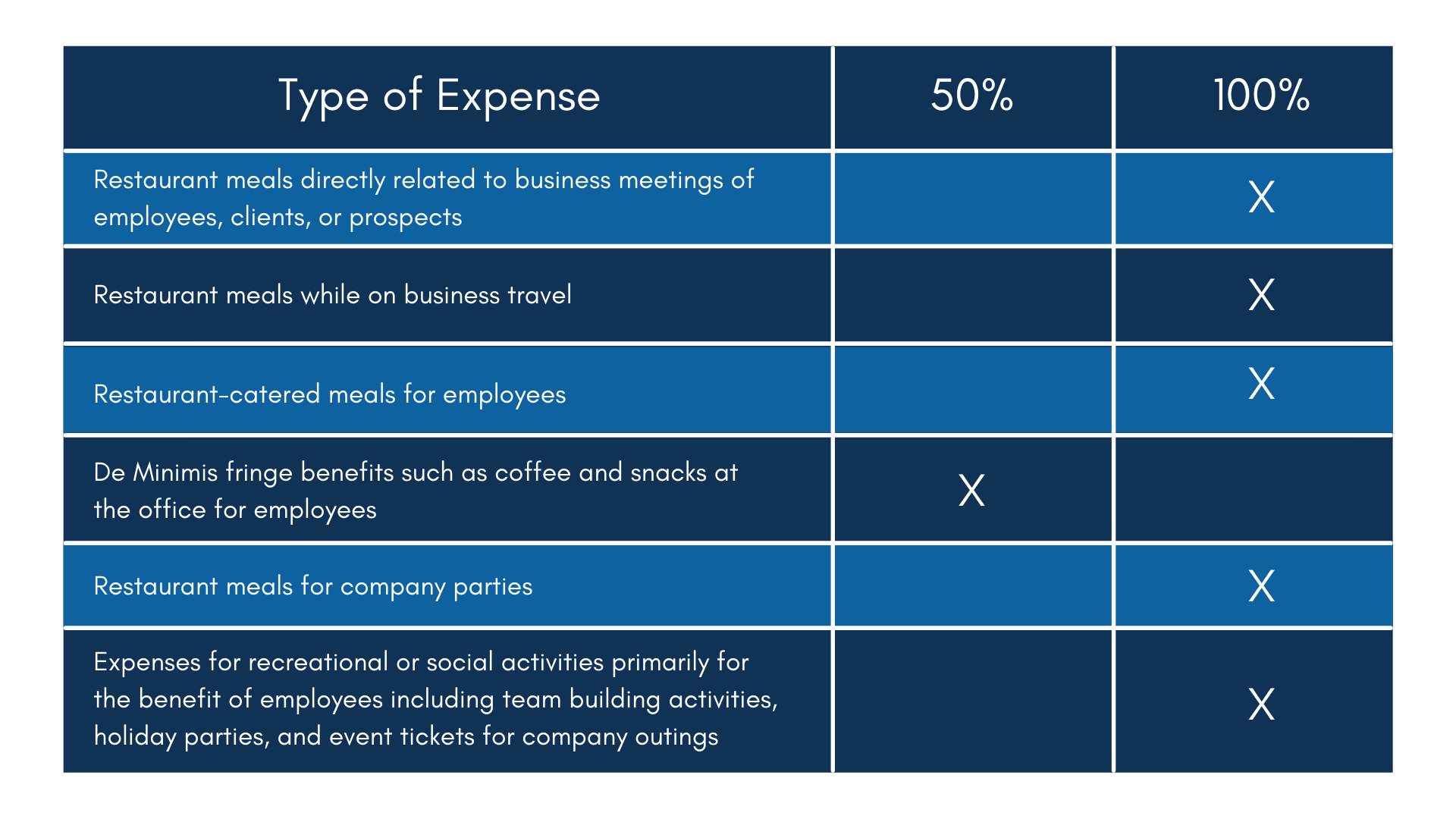

Expanded meals and entertainment expense rules allow for increased, The rules have changed since the 2017 tax cuts and jobs act. Here’s a breakdown of meals and entertainment deductions for 2024 using examples:

Source: spiegel.cpa

Source: spiegel.cpa

2022 Meal & Entertainment Deductions Explained Spiegel Accountancy, You’ll need to report your business. Washington — the internal revenue service issued final regulations on the business expense deduction for meals and entertainment following changes made by.

Source: gmco.com

Source: gmco.com

Here is a summary table of the most popular deductions and how they, Deductions for meals, snacks, overtime meals, entertainment and functions. The irs encourages businesses to begin planning now to take advantage of tax benefits available to them when they file their 2022 federal.

Source: www.cainwatters.com

Source: www.cainwatters.com

Meals & Entertainment Deductions for 2021 & 2022, The comprehensive federal tax reform legislation enacted in late 2017 (the act) made a number of changes to the tax rules affecting the treatment of meals,. Here’s a breakdown of meals and entertainment deductions for 2024 using examples:

Source: lifetimeparadigm.com

Source: lifetimeparadigm.com

Deducting Meals and Entertainment in 2021 2022 Lifetime Paradigm, Writing off meals and entertainment for your small business can be pretty confusing. However, not every expense that goes into business meals and entertainment are.

Source: bh-co.com

Source: bh-co.com

Meals & Entertainment Deductions What’s New for 2021 & 2022 Beaird, If your expenses for luxury water travel include separately stated amounts for meals or entertainment, those amounts are subject to the 50% limit on non. What got cut was client entertainment expenses —.

Source: taxedright.com

Source: taxedright.com

Meals and Entertainment Deduction 2022 Taxed Right, Meals and entertainment rules for 2022 vs 2023. Fully deductible meals and entertainment:

Source: alloysilverstein.com

Source: alloysilverstein.com

100 Deduction for Business Meals in 2021 and 2022 Alloy Silverstein, What got cut was client entertainment expenses —. Washington — the internal revenue service issued final regulations on the business expense deduction for meals and entertainment following changes made by.

Source: taxedright.com

Source: taxedright.com

Meals and Entertainment Deduction Taxed Right, Certain expenses qualify for a 100% deduction. Deductions for meals, snacks, overtime meals, entertainment and functions.

You’ll Need To Report Your Business.

As of january 1, 2023, the meals and entertainment deduction.

Writing Off Meals And Entertainment For Your Small Business Can Be Pretty Confusing.

Taxmatters@ey is a monthly canadian summary to help you get up to date on recent tax news, case developments, publications and.

Here’s A Breakdown Of Meals And Entertainment Deductions For 2024 Using Examples:

This article is tax professional approved.