Oregon Unemployment Tax Rate 2024

Oregon Unemployment Tax Rate 2024. Unemployment insurance tax is administered by the oregon employment department. The unemployment rate in 2024 is projected to be 4.2%, which is low and stable.

In january 2024, the u.s. Unemployment tax rates for employers subject to oregon payroll tax will move to tax schedule three for the 2022 calendar year.

The Unemployment Insurance Tax Rate For New Employers Will Rise Slightly For 2024, From A Rate Of 2.1% Of Taxable Wages Up To $50,900 Per Employee In The 2023 Calendar Year.

The new system, frances online*, supports both unemployment insurance (ui) and paid leave oregon, the new program for family, medical and safe leave as well as.

The Unemployment Insurance Tax Rate For New Employers Will Rise Slightly For 2024, From A Rate Of 2.1% Of Taxable Wages Up To $50,900 Per Employee In The 2023.

Learn more, including how to register, on our news and.

“The Unemployment Insurance Payroll Tax For New Employers Will Rise Slightly In 2024 From The Current Rate Of 2.1% On Taxable Wages Up To $50,900 Per Employee,” Said David.

Images References :

Source: oregonemployment.blogspot.com

Source: oregonemployment.blogspot.com

Oregon Workforce and Economic Information Oregon’s Unemployment Rate, Increases the proportion of employer tax revenues paid into the. These increases were driven by wage growth in 2022, which led.

Source: oregonemployment.blogspot.com

Source: oregonemployment.blogspot.com

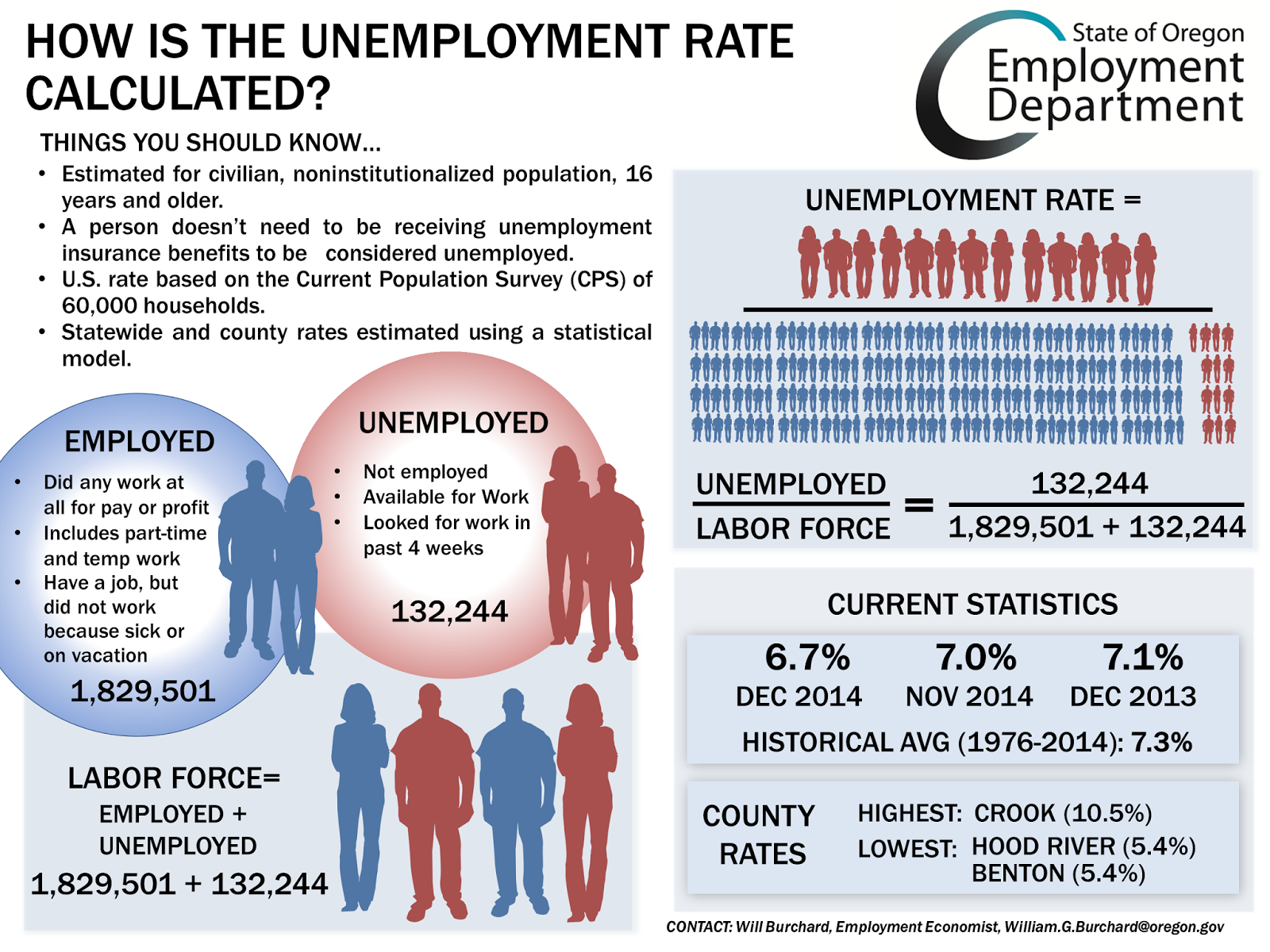

Oregon Workforce and Economic Information How is the Unemployment Rate, How paid leave and boli work together. 2024 combined payroll tax report instruction booklet.

Source: www.oregonlive.com

Source: www.oregonlive.com

Oregon unemployment is 7th highest in U.S. and still above 10 percent, “the unemployment insurance payroll tax for new employers will rise slightly in 2024 from the current rate of 2.1% on taxable wages up to $50,900 per employee,” said david. The paid leave oregon contribution rate for 2024 is 1% of employee wages up to the federal social security taxable wage maximum ($168,600 in 2024).

Source: oregonemployment.blogspot.com

Source: oregonemployment.blogspot.com

Oregon Workforce and Economic Information Lowest on Record Oregon, Oregon’s unemployment tax rates will be determined using schedule 3. Based on schedule iii, tax rates will range from 0.9% to 5.4% with a new employer rate of 2.4%.

Source: oregonbusinessreport.com

Source: oregonbusinessreport.com

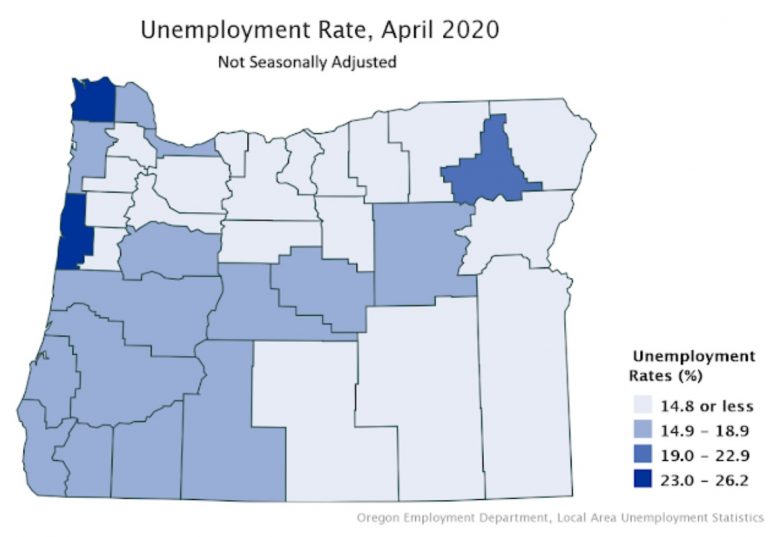

Unemployment rate by county, Relating to unemployment insurance taxes; The fli wage base will rise $35,700 from 2023 to 2024.

Source: www.oregonlive.com

Source: www.oregonlive.com

Oregon regained over 22,000 jobs in May, but 14.2 of labor force, Based on schedule iii, tax rates will range from 0.9% to 5.4% with a new employer rate of 2.4%. Personal income tax rate charts and tables 2023 tax year rate charts and tables.

Source: oregonemployment.blogspot.com

Source: oregonemployment.blogspot.com

Oregon Workforce and Economic Information Oregon's Unemployment Rate, In january 2024, the u.s. In the first six months, paid leave oregon.

Source: oregonemployment.blogspot.com

Source: oregonemployment.blogspot.com

Oregon Workforce and Economic Information Oregon's Unemployment Rate, Relating to unemployment insurance taxes; (ap) — california's unemployment rate is now the highest in the country, reaching 5.3% in february following new data that revealed job.

Source: southernoregonbusiness.com

Source: southernoregonbusiness.com

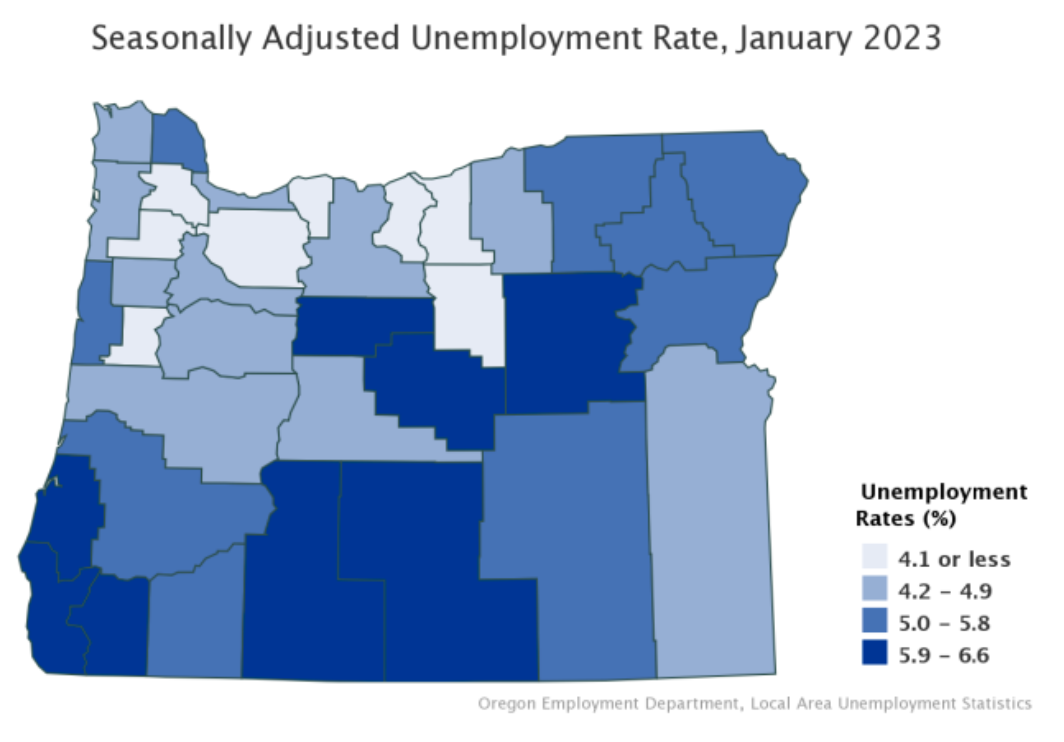

January 2023 Employment and Unemployment in Oregon’s Counties, 2024 payroll tax reporting instructions for oregon employers. Increases the proportion of employer tax revenues paid into the.

Source: oregonemployment.blogspot.com

Source: oregonemployment.blogspot.com

Oregon Workforce and Economic Information Oregon’s Unemployment Rate, Graph and download economic data for unemployment rate in oregon (orur) from jan 1976 to jan 2024 about or,. 2024 combined payroll tax report instruction booklet.

The 2022 Payroll Tax Schedule Is A Modest.

Increases the proportion of employer tax revenues paid into the.

In The First Six Months, Paid Leave Oregon.

Learn more, including how to register, on our news and.